Break-out session: Shrimp Production (part 2)

Scope /

This seminar will address three main questions: (1) Will Chinese domestic production soon become a threat to Chinese shrimp imports from overseas? (2) What are the strategies of Asian producers to remain competitive and find their niche in the marketplace? (3) Does a focus on cooked and breaded products make sense, in order to stay away from direct competition for raw frozen products?

Chairpersons /

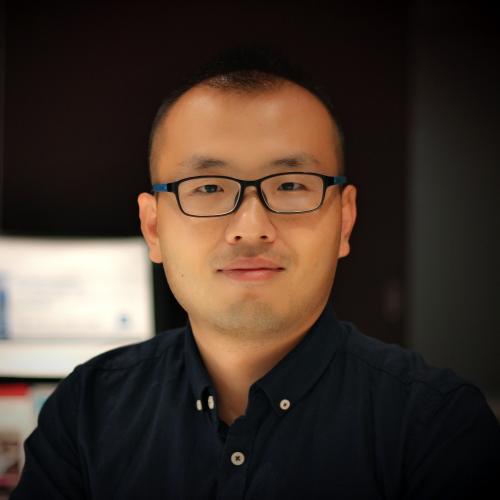

Lisa van Wageningen

Program Manager, Aquaculture

Lisa van Wageningen is Program Manager Aquaculture at IDH, the Sustainable Trade Initiative. IDH is an organization (Foundation) that works with businesses, financiers, governments and civil society to realize sustainable trade in global value chains. IDH convenes action-driven coalitions to drive...

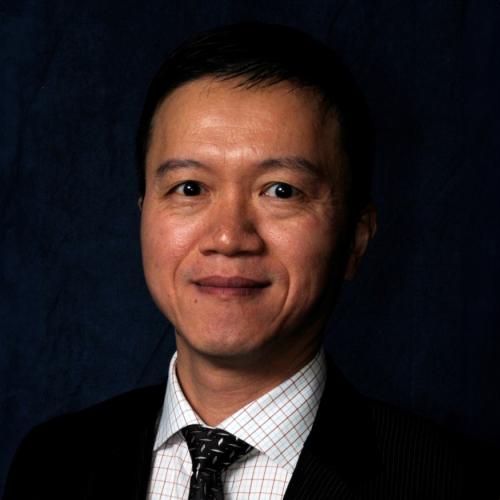

Sander Visch

Lead Analyst, Shrimp Sector

Sander Visch is an experienced seafood industry professional specialising in market analysis and product development. He has an academic background in aquaculture and fisheries obtained from Wageningen University and over 10 years of farm management. Currently, Sander is serving as Lead Analyst...

Speakers /